Let’s Talk.

Start with a conversation. From there, we can build a plan.

Before South Dakota v. Wayfair, Inc. (2018), only businesses with a physical presence in a state were required to charge and remit state sales taxes. This presence, known as a nexus, usually consisted of a storefront, warehouse, or employees, and rarely applied to online sellers. In fact, the terms “nexus” and “sufficient physical presence” could usually be used interchangeably.

As online sales increased rapidly and physical sales decreased, states began to note a loss in tax revenue due to the inability to compel online sellers to effect or remit state sales tax. As a result, many states passed their own laws redefining nexus as an economic factor. However, most of these laws could not be enforced without federal intervention.

The Wayfair decision overturned the law defining nexus in physical terms in favor of economic nexus, which states that online sellers holding significant economic interest in a state must charge state taxes. As a result, sellers were now subject to the various laws dictating revenue or transaction thresholds for requiring state sales tax. Economic nexus laws had just been greenlit, opening the door for changes to Utah’s online state tax rules.

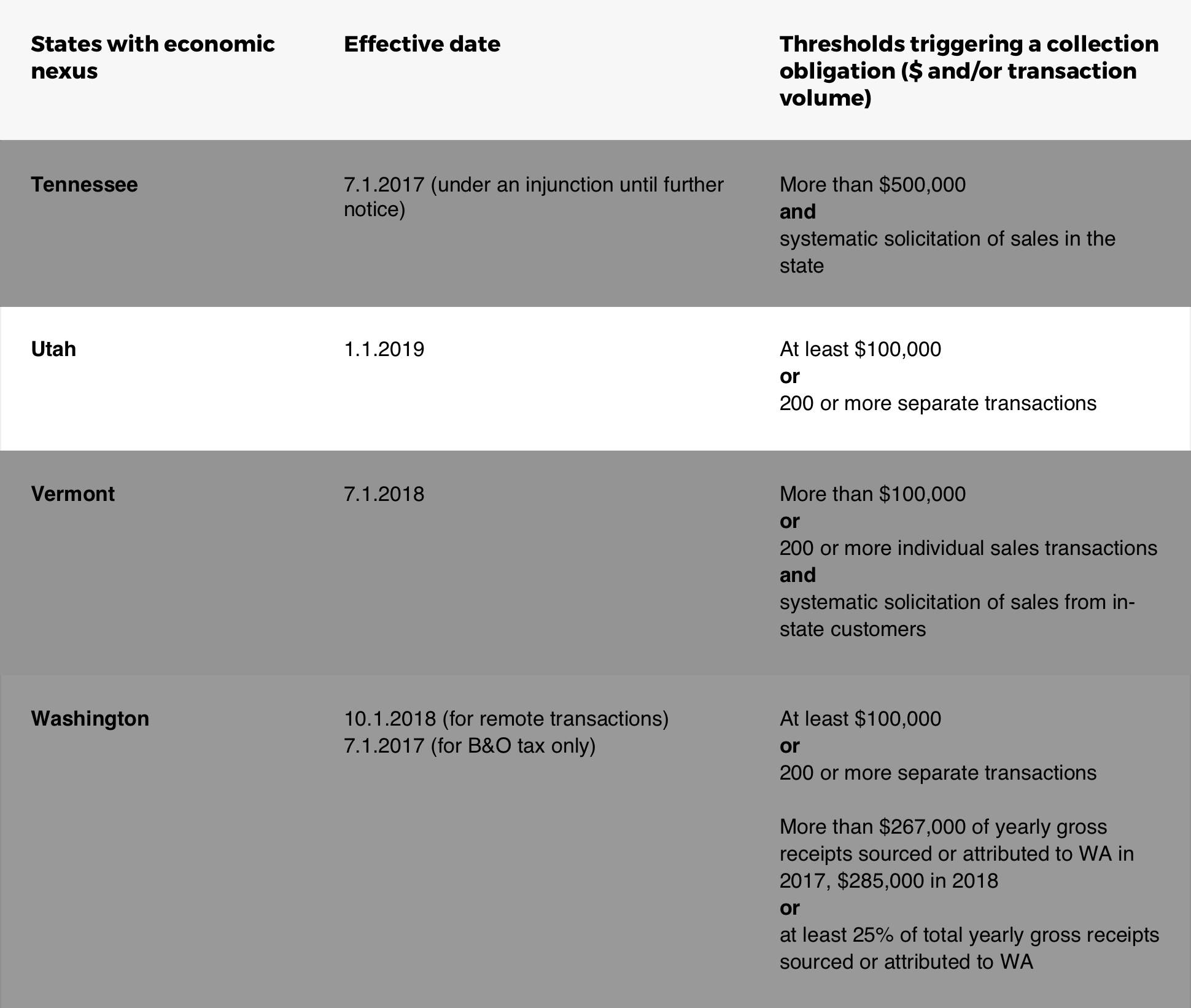

Over 20 states passed laws regarding economic nexus prior to the Wayfair ruling, though most did not enforce them until after the ruling took place. Other states passed laws in the months and weeks that followed, while some are under injunction. In total, 31 states have passed laws changing state sales tax requirements, and changes to Utah online sales tax rules are among them.

Avalara’s complete list of other states with economic nexus laws, as well as the specific thresholds required to trigger nexus, can be found here.

Changes to Utah’s state tax laws became effective January 1, 2019. The economic nexus law states that online sellers are required to collect sales tax online in Utah, if they meet one of the following thresholds in the preceding or current year:

Utah requires businesses to meet only one threshold to incur liability to collect and remit state taxes. If a seller exceeds $100,000 in revenue, they must charge sales tax regardless of sales transactions. If a seller reaches 200 separate transactions, they must charge state sales tax even if revenue falls under $100,000.

You are required to charge sales tax on your website if you sell services, tangible product, or transfer virtual product in the state of Utah and cross one of the thresholds above. Nexus laws in other states differ, so be sure to stay up to date in all states you hold interest. The professionals at Avalara can help you understand the various state tax laws and ensure your business is in compliance with all.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.