Let’s Talk.

Start with a conversation. From there, we can build a plan.

Quill Corp v. North Dakota (1992) was a Supreme Court decision that defined sales tax nexus. The decision stated that in order to charge state sales tax, a business must hold a physical tie to a state such as a storefront, warehouse, or employees. Nexus was also referred to as “sufficient physical presence.”

Once online sales became commonplace, states began to realize that nexus did not apply to most online sellers, resulting in a loss of revenue associated with online sales. As a result, more than 20 states drafted legislation intent on collecting online sales tax. South Dakota’s suit against Wayfair, Inc. was the first to reach the Supreme Court.

On June 21, 2018, the Court ruled in favor of the state in South Dakota v. Wayfair, Inc. and overturned the Quill ruling defining nexus as a purely physical concept. Now, online sellers with sufficient economic activity in these states were subject to state sales tax as well. In essence, this ruling established economic nexus and changed ecommerce rules in South Dakota.

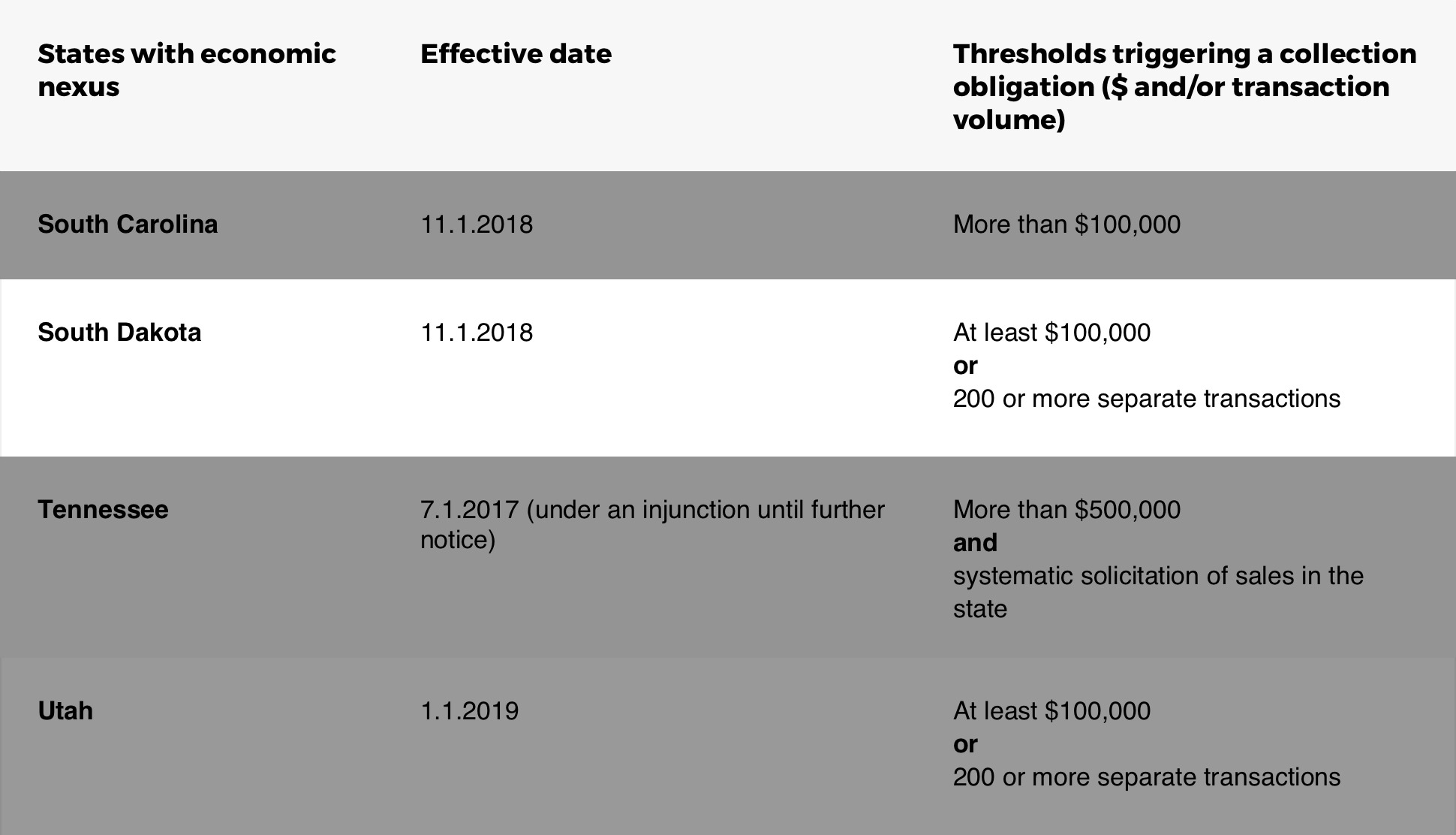

While South Dakota v. Wayfair Inc. was being decided, most other states that had passed similar laws did not enforce them, choosing only to enact their laws after the ruling took place. In the latter half of 2018, more states passed laws of their own, and still more are awaiting court action. Since the ruling, a total of 31 states have passed similar “South Dakota-style nexus laws”.

For a comprehensive list of all states with changes to economic nexus similar to South Dakota’s, see Avalara’s detailed chart here.

Beginning November 1, 2018, online retailers known as remote sellers are subject to South Dakota state taxes under the laws passed on September 1st of that year. Specifically, in order for an online seller to collect sales tax online in South Dakota, one of the following thresholds must be crossed:

South Dakota considers a business eligible for state taxes if it has met only one of these independent thresholds. If a seller grosses over $100,000 in revenue, they must charge and remit state taxes regardless of transaction numbers. Similarly, a remote seller with over 200 separate transactions is liable for state taxes regardless of revenue.

You will need to charge sales tax on your website if you sell a tangible product, transfer a virtual product, or sell services in the state of South Dakota and meet one of the thresholds above. It is worth noting that although South Dakota’s laws were the impetus for the enforcement of other laws, the thresholds and effective dates vary by state. Using a professional service such as Avalara’s can help keep you up to date and streamline your sales tax among states.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.